Under the CPF Housing Scheme, your CPF savings in your Ordinary Account (OA) can be used to purchase residential property in Singapore.

From 10 May 2019, the maximum amount of CPF savings used depends on:

1. The remaining lease can cover the youngest owner using CPF for the property until age 95.

2. No CPF savings can be used if the remaining lease of the property is 20 years or less at the time of purchase.

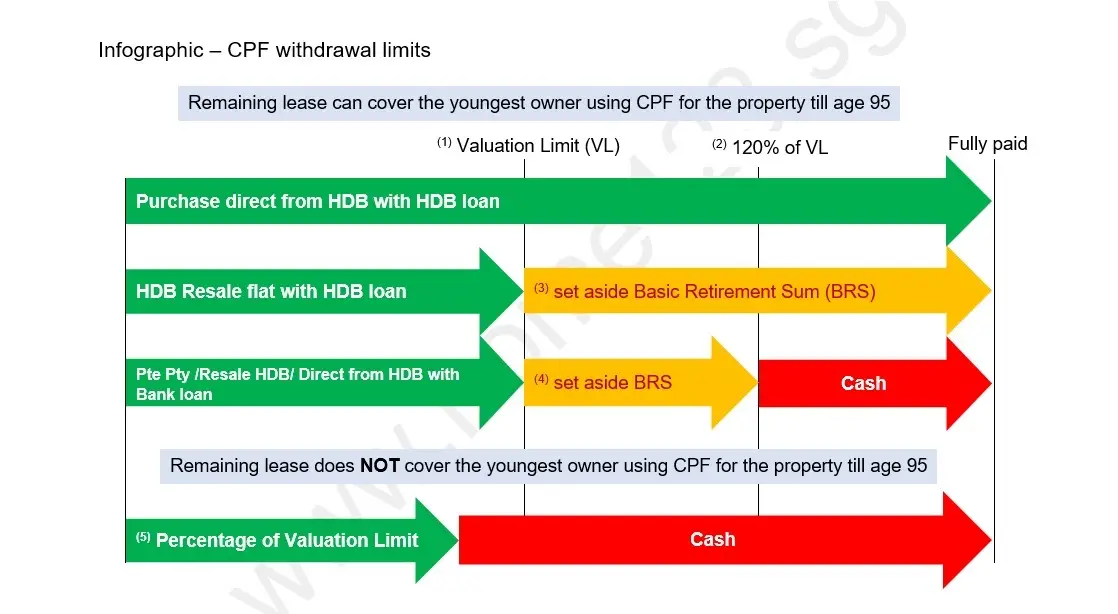

The infographic presented is for buyers who do not have any existing property financed with CPF Ordinary Account (OA) savings.

(1) Valuation Limit (VL)

Valuation Limit is the lower of the purchase price or the valuation of the property at the time of the purchase.

(2) 120% of VL

Additional 20% of the lower of the purchase price or the valuation of the property at the time of purchase.

(3) set aside Basic Retirement Sum (BRS)

CPF savings can be used up to the housing loan taken to buy the flat if you can set aside the Basic Retirement Sum (BRS)

(4) set aside BRS

CPF savings can be used up to an additional 20% of the lower of the purchase price or the valuation of the property at the time of purchase if you can set aside the Basic Retirement Sum (BRS)

(5) Percentage of Valuation Limit

The remaining lease does NOT cover the youngest owner using CPF for the property until age 95.

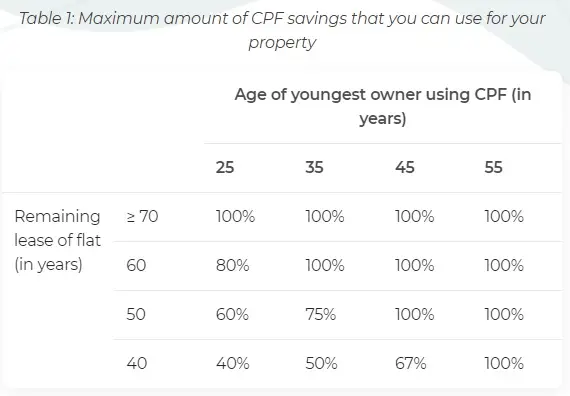

CPF savings can be used capped at a percentage of the lower of the purchase price or the valuation of the property at the time of purchase. Table 1 shows the percentage of Valuation Limit based on the remaining lease of the property at the time of purchase.

Source: https://www.cpf.gov.sg/member/tnc/t-c-for-use-of-cpf-under-cpf-housing-scheme

For example:

Younger buyer age: 35

Remaining lease: 50 years

Maximum amount of CPF can be use: 75% of the Valuation Limit (VL)

You can use the CPF housing usage calculator to estimate the amount of CPF savings that you can use.

I like using infographics to make it simple for people to understand the CPF rules. It takes some effort and time to produce this infographic. If you have any questions, drop me a text or schedule a non-obligation discussion for professional advice.

© 2026 - All rights reserved, Home123.sg