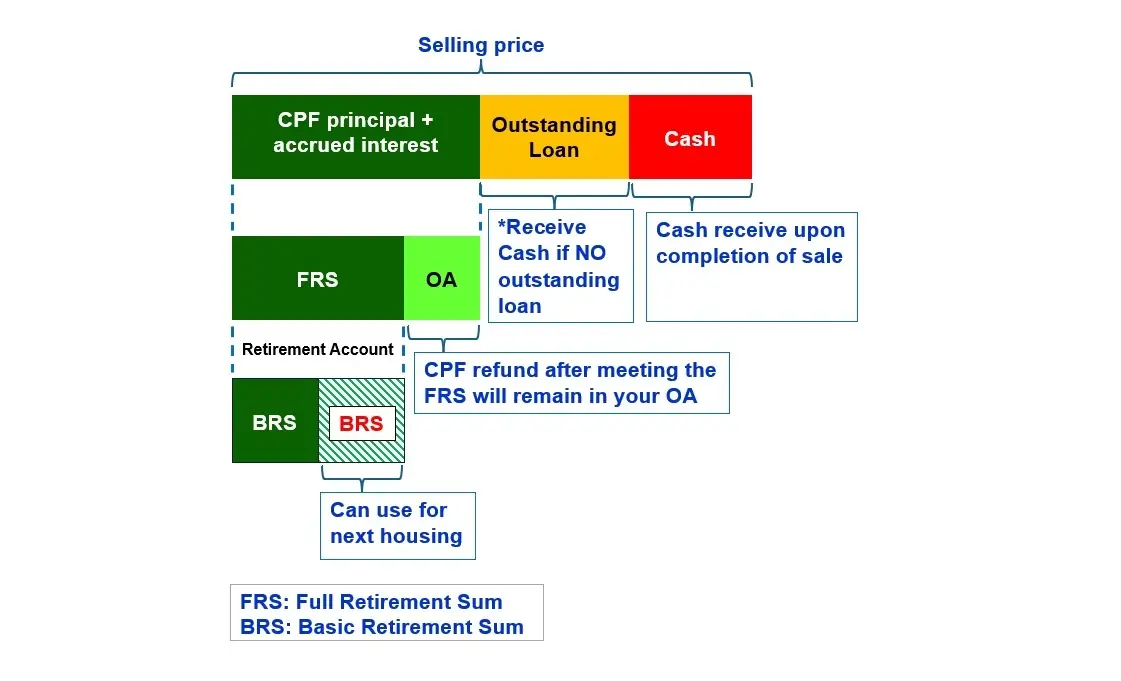

Most of us used CPF monies to finance our HDB flat. This infographic illustrates what happens to the sales proceeds when you sell your HDB flat after age 55.

1. Selling price of your HDB flat consists of 3 parts:

Cash

Outstanding loan

(*Receive Cash if NO outstanding loan)

(CPF principal + accrued interest) Refund

2. (CPF principal + accrued interest) refund to your Retirement Account (RA), if the amount exceeds the Full Retirement Sum (FRS), the balance will remain in your CPF Ordinary Account (OA). You can leave it in your Ordinary Account (OA), transfer it to your Retirement Account (RA), or withdraw it in CASH.

3. CPF amounts in your Retirement Account (RA) that exceed the Basic Retirement Sum (BRS) can be used for the next housing purchase.

Besides selling your HDB flat, there are various options available by HDB for monetising your flat for retirement, like Right-sizing with Silver housing bonus, Renting out your flat or bedroom, etc.

To learn more, schedule a non-obligation discussion now!

© 2026 - All rights reserved, Home123.sg